Stelco Announces First and Second Quarter 2018 Earnings Estimates

Body

HAMILTON, ONTARIO, March 28, 2018 – Stelco Holdings Inc. (“Stelco Holdings”, the “Company” or “we”), (TSX: STLC), which, through its wholly owned operating company, Stelco Inc. (“Stelco” or “Stelco Inc.”), is a low cost, integrated and independent steelmaker with one of the newest and most technologically advanced integrated steelmaking facilities in North America, today provided an update on the market and its operational performance.

Given favourable market conditions for its core steel products, the Company is providing earnings estimates for Q1 and Q2 of 2018.[1]

The Company continues to experience improving market conditions and favourable pricing trends across its key products. The Company also has a strong order book across its hot-rolled coil, cold-rolled coil, and coated products. The Company’s order book is subject to a lag in order entry and revenue recognition with orders being booked today estimated to be delivered in eight to ten weeks. As a result, the Company’s Q1 2018 sales will largely reflect sales orders booked in Q4 2017, and Q2 2018 sales are expected to largely reflect sales orders booked in Q1 2018. In Q1 2018, shipments are expected to be 3% to 5% higher than Q4 2017. In late Q1 2018, the Company expanded its distribution capabilities by adding approximately 200 rail cars to its distribution fleet and increased its shipping capacity through its LEW dock enhancement project. Those enhancements are expected to result in Q2 2018 shipments increasing from Q1 2018 levels. The capital projects described in the prospectus relating to the Company’s IPO remain largely on schedule and on budget.

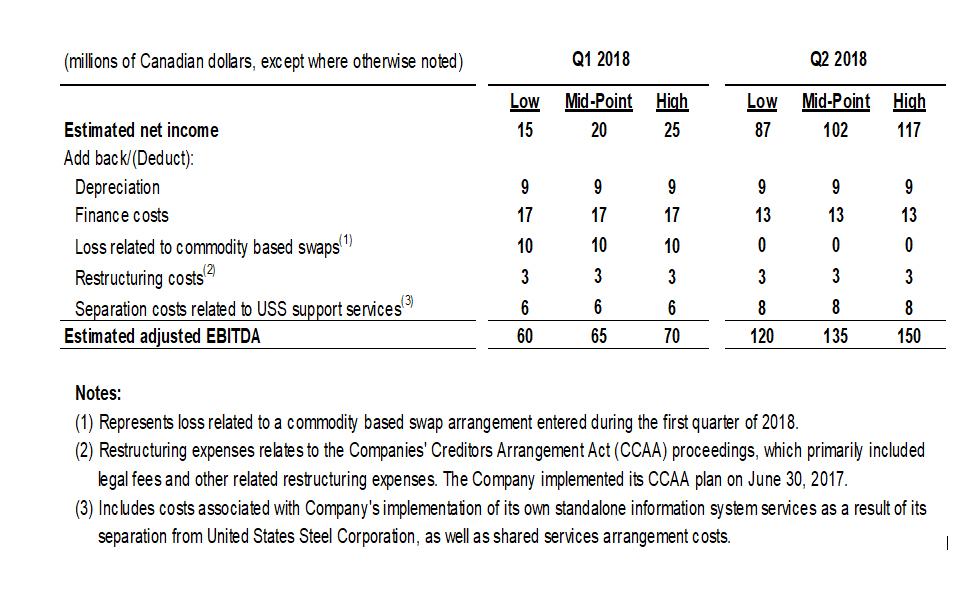

The Company anticipates Q1 2018 adjusted EBITDA to be between $60 million and $70 million, largely reflecting sales orders booked in Q4 2017 at market prices materially below current levels and incremental transportation costs resulting from general shortages of trucks used to deliver products in Q1. The Company anticipates revenue and adjusted EBITDA will improve in Q2 2018 as legacy sales contracts from Q4 2017 roll-off and are replaced by higher price contracts executed in Q1 2018 and as shipping volumes and efficiencies improve. Based upon these expectations, the Company anticipates Q2 2018 adjusted EBITDA to be between $120 million and $150 million.

See “Forward-Looking Information”.

[1] Note: “Q1” refers to the 3 months ended March 31 and “Q2” refers to the 3 months ended June 30.

Reconciliation of Estimated Net Income to Estimated Adjusted EBITDA:

The following table provides a reconciliation of estimated net income (the most directly comparable measure calculated in accordance with IFRS) to the noted estimated adjusted EBITDA (a non-IFRS measure) ranges for Q1 2018 and Q2 2018, as well as the midpoint for each respective range.

Non-IFRS Measures

This press release refers to certain non-IFRS measures that are not recognized under International Financial Reporting Standards (“IFRS”) and do not have a standardized meaning prescribed by IFRS. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and therefore may not be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. We use non-IFRS measures including ‘‘adjusted EBITDA’’ to provide supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS financial measures. We also believe that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Our management uses these non-IFRS financial measures to facilitate operating performance comparisons from period-to-period, to prepare annual operating budgets and forecasts, and drive performance through our management compensation program. For a reconciliation of certain of these non-IFRS measures refer to the “Reconciliation of Estimated Net Income to Estimated Adjusted EBITDA” section above and the “Non-IFRS Performance Measures” in our Management Discussion and Analysis for the period ended December 31, 2017 available on SEDAR at www.sedar.com (the “MD&A”). For a definition of certain non-IFRS measures, refer to the “Non-IFRS Performance Measures” section of the Company’s MD&A.

Key Assumptions Underlying Our Q1 and Q2 2018 Earnings Estimates:

The Q1 and Q2 2018 earnings estimate ranges referenced in this press release are based on a number of assumptions, including but not limited to, the following material assumptions:

- - that the Company’s anticipated margins per net ton will increase largely due to price and volume increases, as well as operating efficiencies, partially offset by inflation in fixed and variable cost structures over the period;

- - steel prices will generally increase period to period consistent with current trends and sales activities over the period;

- - increases in shipping volume as we expand our distribution capabilities through the relevant period;

- - we expect Q1 2018 and Q2 2018 product mix to be comparable to Q4 2017, although as our trial shipments to automotive OEMs continue to see success, we could see a gradual shift in some of our product mix toward higher value products if such shift results in higher margins;

- - the Company’s ability to attract new customers and further develop and maintain existing customers;

- no significant additional legal or regulatory developments, changes in economic conditions, or macro changes in the competitive environment affecting our business activities. We note that potential further changes to trade regulations in the United States or amendments to the North American Free Trade Agreement could materially alter underlying assumptions around our expected financial performance;

- future operating expenses, capital expenditures and debt service costs;

- upgrades to existing facilities remaining on schedule and on budget and their anticipated effect on revenue and costs;

- - the Company’s ability to continue to access the U.S. market without any adverse trade restrictions;

- expectations regarding industry trends, market growth rates and the Company’s future growth rates, plans and strategies to increase revenue and cut costs; and

- - the Company’s ability to increase the volume of shipments to its customers and realize upon the increase in the market price of hot-rolled coil and other steel products.

-

Forward-Looking Information

This release contains ‘‘forward-looking information’’ within the meaning of applicable securities laws. Forward-looking information may relate to our future outlook and anticipated events or results and may include information regarding our financial position, business strategy, growth strategy, budgets, operations, financial results, taxes, dividend policy, plans and objectives of our Company. Particularly, information regarding our expectations of future results, performance, achievements, prospects or opportunities is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as ‘‘plans’’, ‘‘targets’’, ‘‘expects’’ or ‘‘does not expect’’, ‘‘is expected’’, ‘‘an opportunity exists’’, ‘‘budget’’, ‘‘scheduled’’, ‘‘estimates’’, ‘‘outlook’’, ‘‘forecasts’’, ‘‘projection’’, ‘‘prospects’’, ‘‘strategy’’, ‘‘intends’’, ‘‘anticipates’’, ‘‘does not anticipate’’, ‘‘believes’’, or variations of such words and phrases or state that certain actions, events or results ‘‘may’’, ‘‘could’’, ‘‘would’’, ‘‘might’’, ‘‘will’’, ‘‘will be taken’’, ‘‘occur’’ or ‘‘be achieved’’. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances may be forward looking statements. Forward-looking statements are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances. The forward-looking statements contained herein are presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes.

Forward-looking information includes estimates and projections related to the following items, some of which are non-IFRS measures (see “Reconciliation of Estimated Net Income to Estimated Adjusted EBITDA”), among others:

- - adjusted EBITDA;

- - shipments;

- - net Income;

- - deprecation;

- - finance costs;

- - loss related to commodity based swaps;

- - restructuring costs; and

- - separation costs.

-

Undue reliance should not be placed on forward-looking information. The forward-looking information in this press release is based on our opinions, estimates and assumptions in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we currently believe are appropriate and reasonable in the circumstances. Despite a careful process to prepare and review the forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. Certain assumptions in respect of our ability to source raw materials and other inputs; our ability to supply to new customers and markets; our ability to effectively manage costs; our ability to attract and retain key personnel and skilled labour; our ability to obtain and maintain existing financing on acceptable terms; currency exchange and interest rates; the impact of competition; changes in laws, rule, and regulations, including international trade regulations; and growth in steel markets and industry trends, as well as those set out in this press release, are material factors made in preparing the forward-looking information and management’s expectations contained in this press release.

Forward-looking information contained in this press release is subject to risks, including: North American and global steel overcapacity; imports and trade remedies; competition from other producers, imports or alternative materials; and the availability and cost of inputs placing downward pressure on steel prices or increasing our costs; as well as those described in the MD&A and referred to under the heading “Risk Factors” in the Company’s final supplemented prep prospectus dated November 2, 2017 in respect of the Company’s initial public offering that closed on November 10, 2017 and available on SEDAR at www.sedar.com. Forward-looking information contained in this press release is subject to other risks, uncertainties, assumptions and other factors not presently known to us or that we presently believe are not material that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward looking information, which speaks only as of the date made. The forward-looking information contained in this press release represents our expectations as of the date of this news release, and are subject to change after such date. Stelco Holdings disclaims any intention or obligation or undertaking to update publicly or revise any forward-looking statements, whether written or oral, whether as a result of new information, future events or otherwise, except as required by law.

Further Information

For investor enquiries:

Don Newman

Chief Financial Officer

905.577.4432

don.newman@stelco.com

For media enquiries:

Trevor Harris

Vice-President, Corporate Affairs

905.577.4447

trevor.harris@stelco.com